Activity based depreciation calculator

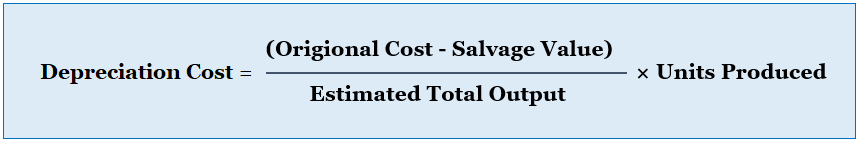

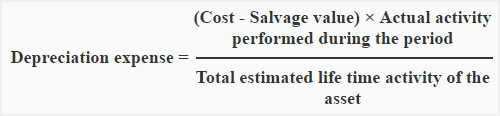

Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. The formula to calculate an activity-based depreciation rate is.

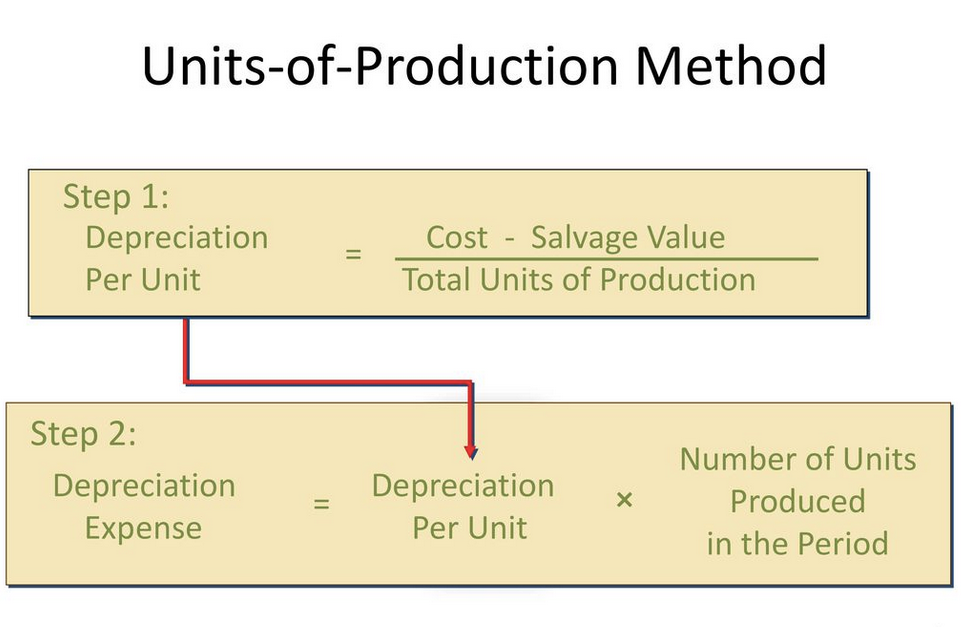

Calculating Depreciation Unit Of Production Method

Service lifecost residual value.

. Estimate the useful life of the fixed assets and calculate the depreciation amount to be reduced from the asset value each year. The activity-based formula simply gives us the dollar value of amount per activity which is then can be multiplied. The activity-based formula simply gives us the dollar value of amount per activity which is then can be multiplied to determine the cost of the total products assigned or.

First you divide the assets cost basisless any salvage valueby the total number of units the asset is expected to produce over its estimated useful life. Study with Quizlet and memorize flashcards containing terms like The formula for straight-line depreciation is a. Under activity method the depreciation expense is calculated on the basis of assets actual operational activity such as the number of units produced or the number of.

There are four main methods to account for depreciation. Ad Find A One-Stop Option That Fits Your Investment Strategy. The activity depreciation method is a cost accounting technique that changes the cost behavior with the fluctuating output.

Calculate the Depreciation Amount to be Considered. Activity-Based Costing Calculator Template. To calculate depreciation based on a different factor use our Declining Balance Calculator.

Here are the steps for the double declining balance method. The straight line calculation as the name suggests is a straight line drop in asset value. Then you multiply this unit cost rate.

This means that the costs are assigned to the activities based on. This activity-based costing calculator template is a great tool to break-down overhead costs through activity-based. Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost 1Life Variable Declining Balance Depreciation.

Divide 100 by the number of years in your assets useful life. This depreciation calculator is for calculating the depreciation schedule of an asset. Get Started In Your Future.

Find Ways to Reduce Your Expenses and Save For Emergencies. The double declining balance calculation does not consider the salvage value in the depreciation of. The quotient you get is the SLD rate.

First one can choose the straight line method of. Ad With a Few Steps The Tool Could Help You Make a Plan Based on Your Budget. Cost residual valueservice life.

The depreciation of an asset is spread evenly across the life. The depreciation rate stays the same throughout the life of the asset used in this calculator. Multiply the value you get by 2.

It provides a couple different methods of depreciation.

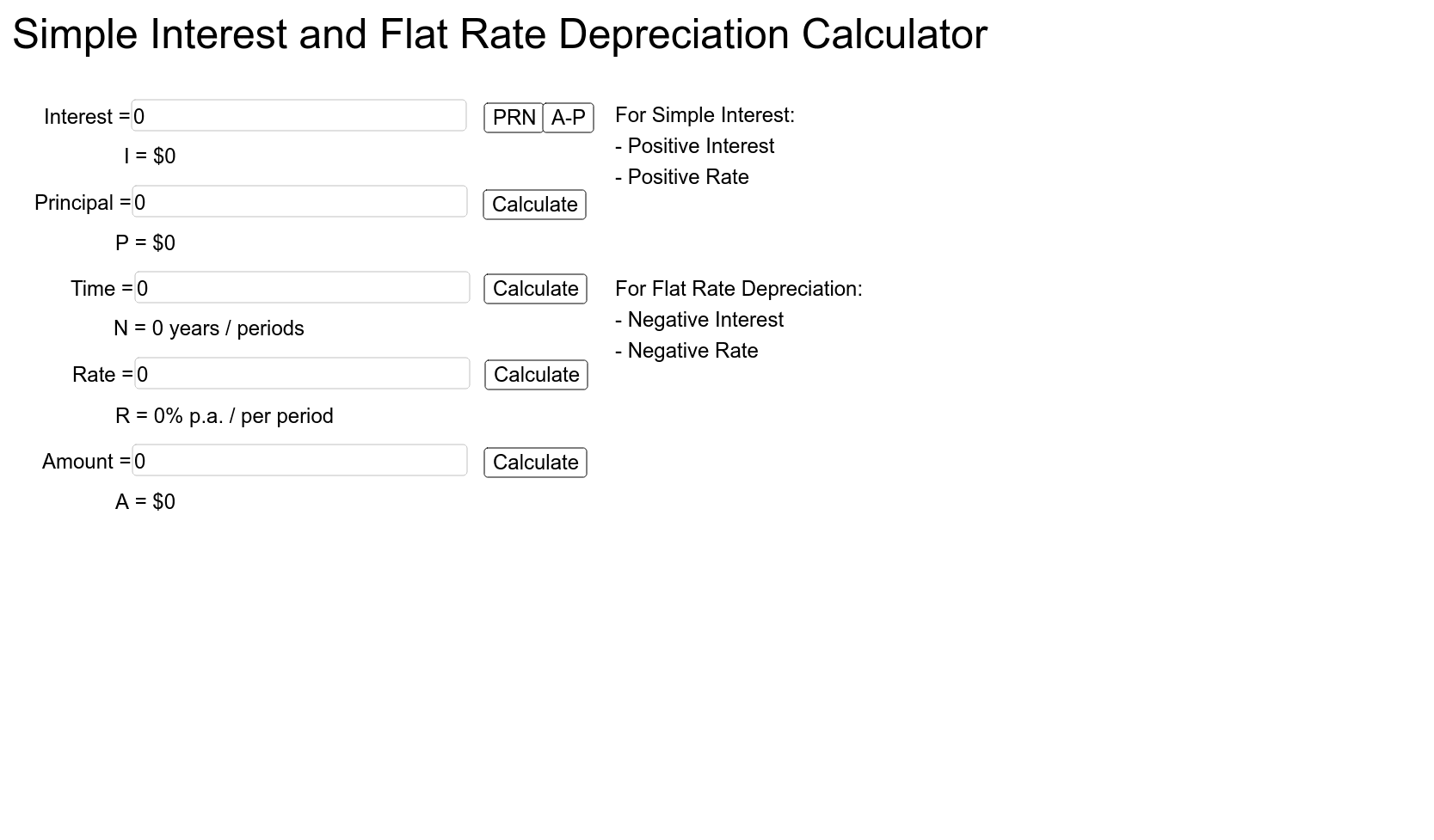

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

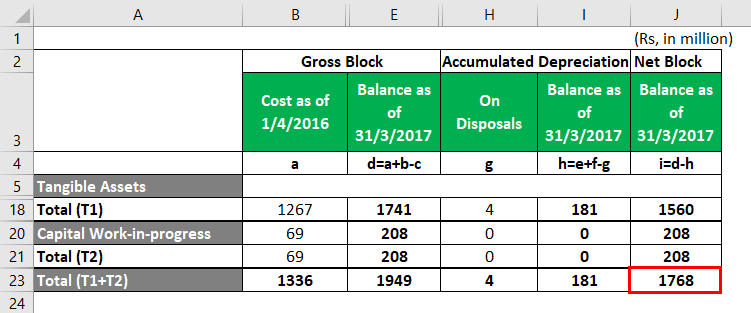

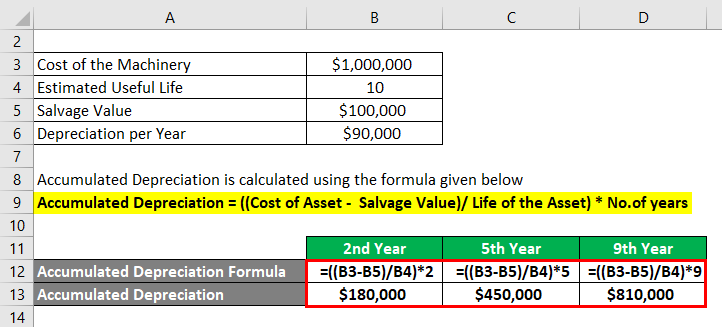

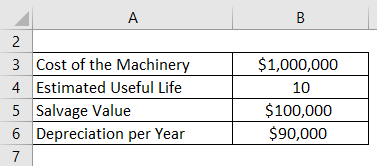

Accumulated Depreciation Formula Calculator With Excel Template

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Straight Line Depreciation Calculator Double Entry Bookkeeping

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

Depreciation Formula Calculate Depreciation Expense

Activity Method Of Depreciation Explanation Formula Examples Accounting For Management

Straight Line Depreciation Formula And Calculator

Units Of Activity Depreciation Calculator Double Entry Bookkeeping